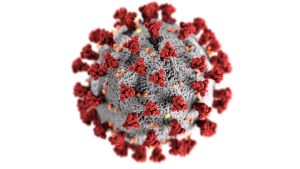

As the general public comes to grips with the fact that the COVID-19 pandemic "era" is here to stay, the biotech sector is whetting its appetite for a potentially booming post-COVID golden age for its business. Christiana Bardon, a portfolio manager at PE firm MPM Capital, said that because biotech companies "generated all the life-saving drugs, vaccines, and therapeutics that literally just saved the world,” investor enthusiasm and general interest in the industry is at an all-time high.

The quick turnaround on COVID vaccine development from Pfizer and Moderna is by itself history-making, but the application of human-untested mRNA technology in those doses truly turned heads. With slightly less than 400 million shots given in the U.S. alone, it's easy to see why both long-term investors and speculators want in on the lucrative vaccine enterprise.

The iShares Biotechnology ETF, which keeps tabs on biotech luminaries, has managed to outpace the S&P 500 of late, swelling by 62% over the past two years—compared to S&P's 47% increase in the same time frame.

There are downsides to this recent surge in biotech interest. Smaller companies are being pitted against one another in the search for viable lab space and experienced researchers, both of which are hot commodities in an industry where property and talent are highest-bidder possessions. On the other hand, more funding in the sector and critical takeaways from COVID analysis could be game-changers in areas such as cancer research and clinical trial streamlining.